latest cryptocurrency news april 2025

Publicado por soni@xenelsoft.co.in en Aug 20, 2025 en Uncategorized | Comments Off on latest cryptocurrency news april 2025Latest cryptocurrency news april 2025

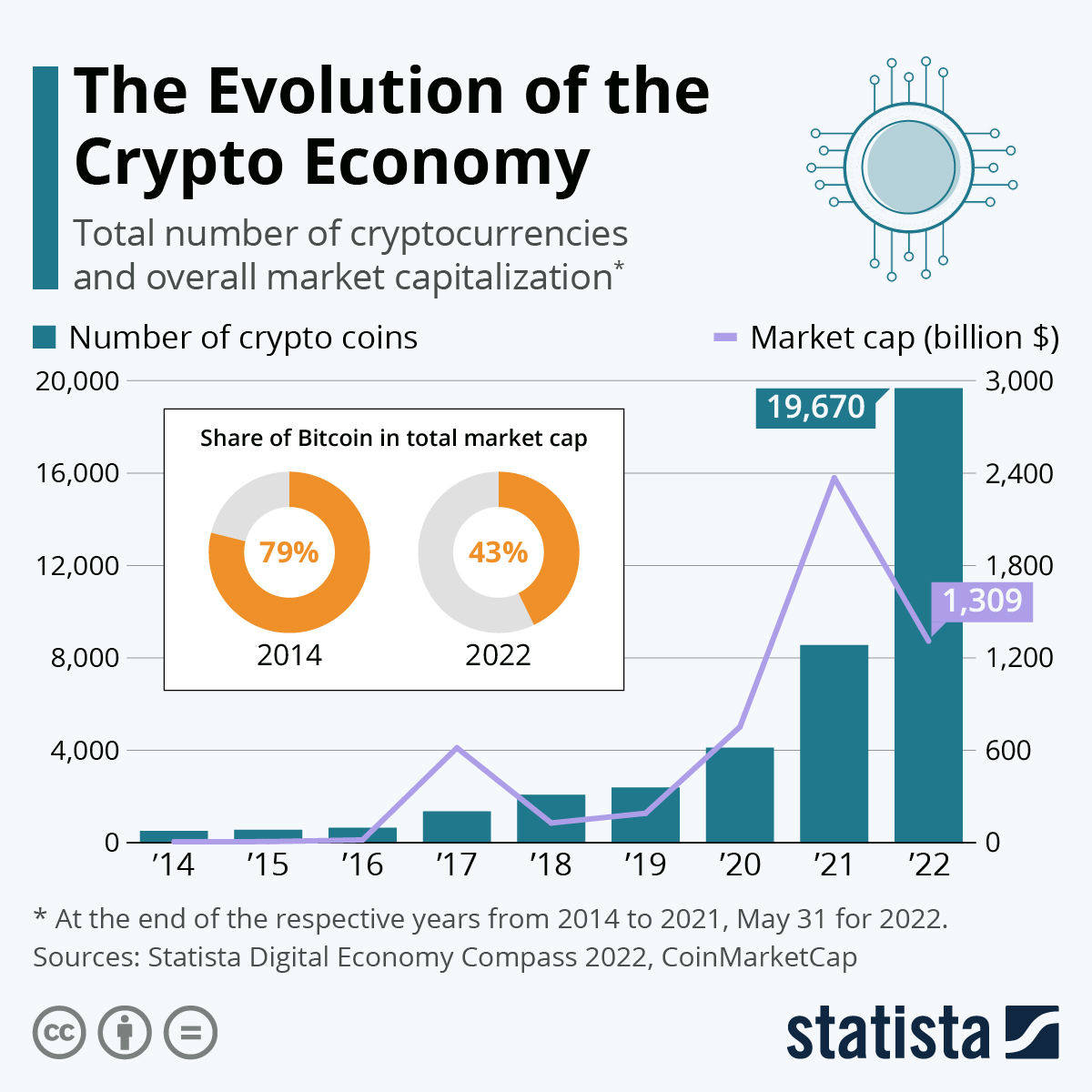

Since its inception, the cryptocurrency market has experienced significant fluctuations, marked by substantial peaks and troughs, widespread adoption, and heightened regulatory oversight https://las-atlantis.org/. As we approach 2025, several pivotal trends and monetary policy are expected to impact the future of cryptocurrencies significantly. This article will explore these trends and their potential impact on cryptocurrency.

By investing in $INDX tokens, you gain access to staking rewards and other benefits, while CryptoIndex handles the complexities of crypto portfolios for you. Even better, you can start with a 74% discount on $INDX, which is still live.

The double bottom formation in STR’s price chart is a significant indicator of potential market reversal. This technical analysis suggests that if STR can maintain momentum above the resistance level, it could influence broader cryptocurrency sentiment positively. For investors, understanding these patterns could be crucial for timely decision-making.

On March 18, 2025, the cryptocurrency market showed mixed signals. Strategy (STR) displayed a bullish double bottom formation on its price chart suggesting a potential rally with a target price of $410 if it surpasses the resistance at $320.94. This pattern indicates a possible exhaustion of the downtrend, contrasting sharply with Bitcoin’s bearish double top formation.

As with any emerging technology, the path forward for cryptocurrencies is uncertain. However, by paying attention to these key trends, investors and enthusiasts can better navigate cryptocurrencies’ dynamic and fast-evolving world—2025 promises to be a pivotal moment in the history of this fascinating market.

Cryptocurrency market trends 2025

That’s all changed, with governments worldwide getting to grips with crypto regulation. But policies vary massively by country, and the US has favored a more hands-off approach since the re-election of Donald Trump.

Rising institutional adoption, innovative applications in DeFi and NFTs, the expansion of Bitcoin ETFs and more formal regulatory frameworks worldwide are all influential. Meanwhile, the new U.S. administration’s combination of tariffs and crypto-friendly initiatives reflects the market’s complex, often contradictory signals.

That’s all changed, with governments worldwide getting to grips with crypto regulation. But policies vary massively by country, and the US has favored a more hands-off approach since the re-election of Donald Trump.

Rising institutional adoption, innovative applications in DeFi and NFTs, the expansion of Bitcoin ETFs and more formal regulatory frameworks worldwide are all influential. Meanwhile, the new U.S. administration’s combination of tariffs and crypto-friendly initiatives reflects the market’s complex, often contradictory signals.

An additional 2025 trend involves corporate giants experimenting with tokenizing traditionally illiquid assets such as real estate, private equity stakes and commodities. This tokenization wave has introduced new liquidity channels, attracting global investors seeking diversification. Though some critics warn about transferring high volatility into previously stable markets, proponents argue these tokens democratize investment by enabling fractional ownership.

Bitcoin will cross $150k in H1 and test or best $185k in Q4 2025. A combination of institutional, corporate, and nation-state adoption will propel Bitcoin to new heights in 2025. Throughout its existence, Bitcoin has appreciated faster than all other asset classes, particularly the S&P 500 and gold, and that trend will continue in 2025. Bitcoin will also reach 20% of Gold’s market cap. -Alex Thorn

Cryptocurrency market update april 2025

The common narrative is that cryptocurrency ownership skews young. And that’s largely true. About half of Millennials and Gen Z respondents globally said they either currently own crypto or have in the past, at 52% and 48%, respectively. That’s significantly higher than the general global population, at 35%.

The Pectra upgrade is Ethereum’s first major technical update in nearly 11 months, combining the “Prague” and “Electra” upgrade plans, mainly focusing on wallet experience optimization and validator mechanism reform. These improvements are believed to potentially attract more institutional and individual users, especially by lowering the staking threshold and enhancing wallet experience, directly benefiting Ethereum ecosystem adoption rates.

US February CPI data was: year-on-year increase of 2.8%, core CPI year-on-year increase of 3.1%, persistently higher than the Fed’s target level. If this data is higher than expected (e.g., core CPI ≥2.8%), it may trigger market concerns about “stagflation,” the crypto market may experience short-term selling, Bitcoin may test key support levels, even touching a new low of $76,000.

The common narrative is that cryptocurrency ownership skews young. And that’s largely true. About half of Millennials and Gen Z respondents globally said they either currently own crypto or have in the past, at 52% and 48%, respectively. That’s significantly higher than the general global population, at 35%.

The Pectra upgrade is Ethereum’s first major technical update in nearly 11 months, combining the “Prague” and “Electra” upgrade plans, mainly focusing on wallet experience optimization and validator mechanism reform. These improvements are believed to potentially attract more institutional and individual users, especially by lowering the staking threshold and enhancing wallet experience, directly benefiting Ethereum ecosystem adoption rates.

US February CPI data was: year-on-year increase of 2.8%, core CPI year-on-year increase of 3.1%, persistently higher than the Fed’s target level. If this data is higher than expected (e.g., core CPI ≥2.8%), it may trigger market concerns about “stagflation,” the crypto market may experience short-term selling, Bitcoin may test key support levels, even touching a new low of $76,000.