Opulatrix Finance Tips for Smart Investment Management

Publicado por soni@xenelsoft.co.in en Sep 7, 2025 en ENGLISH | Comments Off on Opulatrix Finance Tips for Smart Investment ManagementOpulatrix Finance – Managing Your Investments Efficiently

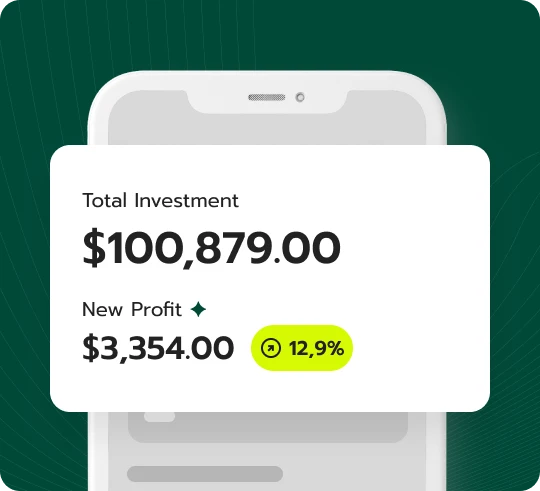

Start tracking your investments closely. Regularly monitor performance metrics to identify trends and make informed decisions. Utilize tools such as spreadsheets or investment apps to keep everything organized. These methods allow for real-time adjustments, maximizing your potential returns.

Set clear, measurable goals for your portfolio. Define what success looks like for you, whether it’s achieving a specific return on investment or saving for a major purchase. Clear objectives not only guide your investment choices but also help maintain focus during market fluctuations.

Diversification serves as a powerful strategy in mitigating risks. Allocate your capital across various asset classes, such as stocks, bonds, and real estate. This way, a downturn in one area won’t disproportionately affect your entire portfolio, enhancing your resilience during market volatility.

Stay informed about market trends and economic forecasts. Subscribe to financial news sources and newsletters that provide insights relevant to your investments. Knowledge equips you to pivot your strategy when necessary and seize emerging opportunities that align with your goals.

Lastly, don’t shy away from seeking professional advice. Consulting with a financial advisor can provide personalized insights tailored to your circumstances. They can help you navigate complex investment choices and refine your approach for long-term success.

Choosing the Right Asset Allocation Strategy for Your Portfolio

Determine your risk tolerance. Assess how much risk you can comfortably handle, which shapes your investment approach. High-risk tolerance allows for a greater equity allocation, while low tolerance leans toward bonds and cash equivalents.

Consider your investment horizon. Short-term goals typically require less exposure to volatile assets, favoring stability. Longer timelines can support equities, benefiting from market growth over time.

Utilize the 60/40 rule. A common strategy divides your portfolio into 60% stocks and 40% bonds. This blend balances growth potential with risk mitigation, making it suitable for many investors.

Explore age-based allocation. Subtract your age from 110 to determine your stock allocation percentage. For instance, if you’re 30, allocate 80% to stocks and 20% to bonds. Adjust this as you grow older to decrease risk.

Incorporate diversification. Spread investments across various asset classes–equities, bonds, real estate, and commodities. This approach minimizes the impact of underperformance in any single asset class.

Regularly rebalance your portfolio. Periodically check your allocations and adjust to maintain your intended strategy. This practice prevents drift caused by varying asset performances and helps control risk.

Stay informed about market conditions. Economic indicators, interest rates, and geopolitical events can influence your strategy. Being proactive allows you to make timely adjustments to your portfolio.

Finally, consult a financial advisor if needed. An expert can provide personalized strategies based on your unique situation, ensuring a tailored approach to asset allocation.

Utilizing Data Analytics to Make Informed Investment Decisions

Use predictive analytics to forecast market trends. Analyze historical data along with current financial indicators to identify patterns that can indicate future performance. Leverage powerful algorithms to assess the probability of various scenarios occurring, which aids in evaluating potential investments.

Integrate visualization tools to interpret complex data sets effectively. Present data using charts and graphs to simplify understanding and make it easier to spot trends and anomalies. Visualization enhances comprehension of investment risks and opportunities.

Employ sentiment analysis to gauge market sentiment surrounding specific stocks or assets. Monitor social media, news, and financial reports to capture public opinion and its potential impact on investment value. This real-time feedback can be invaluable for adjusting strategies.

Utilize risk assessment models to measure potential outcomes systematically. Assess the volatility and return profiles of investments by using metrics such as Value at Risk (VaR) and Sharpe Ratio. These tools help to determine which investments align with your risk tolerance.

Regularly track portfolio performance through analytics dashboards. Set benchmarks and measure how your investments stack up against market indices or other portfolios. Adjust your strategy based on data-driven insights to optimize returns.

Incorporate machine learning techniques for refined decision-making. Train models on historical data to enhance predictive accuracy regarding asset price movements. These methods help streamline decision processes and minimize human error.

Stay informed by following analytics-driven platforms. Resources like opulatrix Investment provide insights derived from vast datasets, ensuring that your investment strategies are based on solid, data-backed analysis.

Q&A:

What are the key tips for managing investments wisely according to Opulatrix Finance?

Opulatrix Finance highlights several important strategies for smart investment management. First, they recommend diversifying your portfolio to reduce risk. This means spreading your investments across various asset classes—stocks, bonds, real estate, and others. Secondly, maintaining a clear understanding of your financial goals is crucial; this will guide your investment choices. Regularly reviewing and adjusting your portfolio based on market conditions and personal circumstances is also essential. Lastly, they stress the importance of educating yourself continuously about market trends and investment options to make informed decisions.

How can diversification improve my investment strategy?

Diversification can significantly enhance your investment strategy by minimizing the risk associated with market volatility. By spreading your investments across different asset classes and sectors, you can protect your portfolio from significant losses if one particular area underperforms. For example, if stocks are struggling, bonds or real estate may still provide returns. This balance creates a more stable investment environment, ultimately leading to better long-term performance. Opulatrix Finance suggests that a well-diversified portfolio can also tap into various growth opportunities across different regions or industries.

What role does market education play in investment management?

Market education is fundamental to successful investment management. Being well-informed about market trends, economic indicators, and various investment products helps you make better decisions. Opulatrix Finance encourages investors to stay updated through reading financial news, attending seminars, and taking courses. This knowledge empowers you to identify potential opportunities and avoid pitfalls. Additionally, understanding the risks and rewards of different investments allows you to align your portfolio with your risk tolerance and financial objectives.

How frequently should I review my investment portfolio?

According to Opulatrix Finance, the frequency of portfolio reviews largely depends on your investment strategy and market conditions. However, a common recommendation is to review your portfolio at least quarterly. This regular assessment allows you to make necessary adjustments based on performance and changes in your financial goals or market dynamics. Annual reviews are also advisable to ensure that your overall strategy remains aligned with your objectives, especially if there are significant life changes such as a new job, moving, or changes in family status.

What common mistakes should I avoid in investment management?

Opulatrix Finance identifies several common mistakes that can hinder investment success. One major pitfall is chasing past performance; many investors rush to invest in assets that have recently performed well without understanding the underlying factors that drove that performance. Another mistake is neglecting to diversify, which can expose you to higher risks. Emotional investing, such as selling during market dips or buying during peaks, is another frequent error. Additionally, failing to have a clear investment plan can lead to disorganized decisions. Learning from these mistakes can foster more disciplined and rational investment practices.

Reviews

Anna

Hey there! I couldn’t help but wonder, how do you balance the thrill of investing with the need to keep your sanity intact? Do you have any quirky rituals or lucky charms that guide your decision-making? I’d love to hear how you stay grounded while making those bold moves in the finance world!

Olivia

I’m really concerned about the investment risks involved.

CosmicRider

Investing can feel overwhelming, but with the right guidance, it becomes a path filled with opportunities. Let’s focus on strategies that genuinely make a difference!

Daniel

Ah, the tips for smart investment management, right? Because who wouldn’t want to follow the advice of someone who probably made their fortune selling “get rich quick” schemes on late-night TV? I can just picture it: sophisticated spreadsheets filled with fortune-cookie wisdom. Just sprinkle some magic pixie dust, and voilà! Instant wealth! Let’s all pretend this isn’t just a high-stakes poker game with more spreadsheets.

Anna Smith

Have you ever pondered the delicate balance between instinct and strategy in managing your investments? In a world filled with opportunities, it’s easy to get swept away by trends that glitter but may not last. How do you all maintain clarity in your financial decisions? Do you rely on analytical tools, or do you trust your gut feelings? It fascinates me to hear your thoughts on blending personal intuition with sound advice when crafting a prosperous investment approach. What practices have truly resonated with you on this path?